The utilization of Sermazade brings key features to crypto trading by applying real-time artificial intelligence to market analysis. It continuously evaluates the latest data and delivers quick assessments to support wise decisions at optimal times.

Using machine learning, Sermazade monitors market performance and interprets complex human behaviors. Signals provided to traders reflect the current scenario rather than past data or emotions, guiding better investment choices.Due to cryptocurrency volatility, both gains and losses are possible.

Sermazade also offers a dial function to follow traders, enabling safer bets on proven strategies. Its user-friendly interface, practical models, and risk management tools enhance member engagement and promote secure trading.

Sermazade’s AI-powered instruments analyze market indicators and quickly react to changes, providing a flexible analysis engine with real-time movement tracking as standard.

Sermazade continuously monitors and analyzes crypto data in real-time—the hallmark of this conversion funnel. It simplifies complex signals, helping traders make clearer decisions. By accurately identifying patterns, Sermazade reduces market uncertainty, replacing guesswork with precise, data-driven evaluation for smarter trading choices.

Sermazade is an advanced AI-based tool that identifies key trends in digital currencies by analyzing current and historical data. It filters emerging patterns and presents them clearly in concise panels. Users make quick, informed decisions based on practical, visual insights—avoiding guesswork and delayed reactions.

Sermazade equips users to trade by offering AI-driven strategies inspired by successful traders. Users who may not grasp market behavior or rely on intuition can apply proven methods with clear rationale. These systematic approaches engage both beginners and seasoned practitioners through well-developed, relevant ideas designed to significantly enhance trading effectiveness.

Multiple encryption layers, anonymized data channels, and continuous penetration testing enable Sermazade to preserve confidentiality for every analytic request. Users, never placing orders, still explore insights within a secure shell.

Machine-learning models swiftly parse incoming traffic, enabling Sermazadeto detect sharp upward signals with minimal latency. Cryptocurrency markets swing wildly; losses are possible. Each system refinement heightens predictive precision, steadily enhancing foresight and reinforcing previous performance gains for sustained reliability.

Watchlists, depth charts, and copy-trading suggestions appear via Sermazade, guiding traders' corrective actions on fresh data while upholding strict security standards and maintaining effortless navigation.

In particular, Sermazade employs advanced machine-learning models to analyse cryptocurrency trading cycles. Tactically, Sermazade captures significant shifts in trading behaviour, monitors real-time metrics, and delivers timely recommendations. This dynamic insight highlights emerging trends and furnishes actionable guidance, letting traders align swiftly with unfolding market activity and improve decision-making.

Although crypto markets can swing violently, Sermazade continuously tracks every leading coin, filtering out irrelevant noise even during spikes. Its AI spots only significant price shifts, evaluating additional market cues to surface timely, disciplined entry signals—without distraction, hesitation, or keyword-flawed execution, plus frozen keyword safeguards.

The objective of Sermazade is to deliver every user a tailored experience, backed by expert guidance. Step-by-step explanations span beginner to advanced levels, reducing confusion. Pragmatic design turns complexity into clarity, letting traders absorb actionable insights instead of wrestling with interface mechanics or technical hurdles.

AI experts often use Sermazade to analyze live market conditions, detect emerging signals, and generate actionable insights. Its adaptive intelligence tracks asset shifts in real time, offering user-friendly, expert-level guidance for both novice and seasoned traders alike.

So as to facilitate each trade conducted, the Sermazade has a clever and on-call guidance component. While exploring platform capabilities or troubleshooting issues, users receive step-by-step instructions and real-time guidance, ensuring smooth session flow, uninterrupted usage, and increased platform efficiency through intelligent support integration.

Maneuvering through the complicated world of cryptocurrency is like riding a rollercoaster, targeting significant market changes tailored to user needs. Sermazade aligns all critical parameters on a clear timeline, helping optimize entry and exit timing by offering both a broad overview and detailed signal insights from complex market patterns.

No more guessing—only pattern recognition. Sermazade deciphers chaotic price fluctuations, with alerts enabling users to act before major shifts.

Equipped with strong encryption and ID verification for secure access, Sermazade includes smart tools, customizable modules, and a user-friendly help desk. Cryptocurrency trading carries an inherent risk of financial loss.

Sermazade enables users to stay informed about crypto market fluctuations by offering structured reports based on short-term movements and long-term trends. This clarity supports more effective decision-making and strategic analysis.

Using advanced algorithms, Sermazade detects relevant data in real-time, continuously refining insights. Its adaptive intelligence empowers traders to fine-tune their strategies with precision, helping them align better with market behavior.

Markets change at different speeds. With Sermazade, users can analyze both short-term spikes and long-term strategies in one place, helping them decide whether to react to rapid shifts or align with sustained growth patterns for better decision-making.

The Sermazade acts as a liquidity zone tracker, helping traders identify active trading ranges. With volume bars and equity visuals, it highlights when buying or selling is easier or harder, aiding strategic timing through awareness of price action behavior.

By making use of the Sermazade, individuals also concentrate on controlled risk growth strategy by considering how realistic the entry and exit levels are. Accessible tools, translate price signals into actionable global maxima threshold, within which an individual can actually perform, would be availed. Such defined control that is needed when approaching risk, especially in changing situations, makes the process of risk planning quite ought.

By using advanced tracking technologies, the Sermazade system streamlines trading activities, ensuring all actions align with predefined goals. It discourages impulsive decisions, offering only relevant insights to maintain discipline and improve execution amidst volatile market conditions.

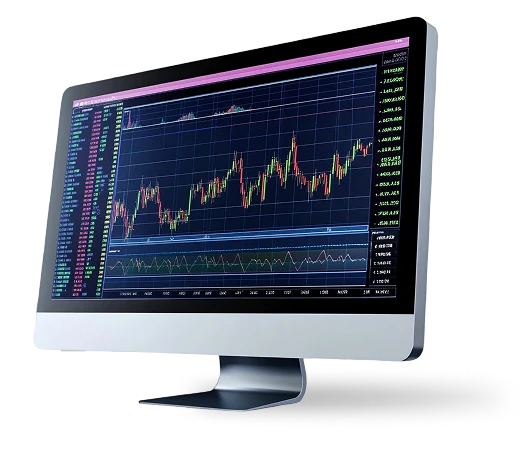

Sermazade equips users with essential analysis tools like MACD, Fibonacci levels, and the Stochastic Oscillator. These tools help identify price influences and detect potential market pivot points or upcoming shifts.

The application is designed so each tool plays a specific role—Fibonacci marks key levels, MACD shows price trend momentum, and the Stochastic Oscillator reflects market conditions.

Together within Sermazade, these instruments support calm, strategic, and sometimes bold decisions in the fast-moving crypto environment.

The process facilitated by Sermazade on a live database detects crypto price behavioral changes driven by emotional shifts resulting from topical news and market or trader reactions. Based on this data, the likelihood of positive or cautious sentiments prevailing is better assessed.

It integrates AI-powered sentiment analysis engines to process large volumes of information and capture investor mood swings. Beyond surface sentiment, Sermazade helps evaluate turnaround points and renewed optimism. Conversely, rising apprehension signals potential corrections.

By generalizing these findings through emotion metrics, Sermazade enhances logical decision-making, guiding where to invest or hold back in the current market climate.

Sermazade allows traders to examine the connections between macroeconomic phenomena and the fluctuations in the cryptocurrency market, for instance, the inflation report, employment level, interest rates and others. By examining these exogenous forces, the system demonstrates that factors other than the developments within the crypto market itself, can determine the direction of prices or investors’ moods.

It also traces the influence of policy, law, or tax changes. Analyzing how previous announcements have induced volatility helps Sermazade to prepare the users for the likely reactions following an event. This offers a proactive perspective to manage transitions induced by policies.

Sermazade interprets massive amounts of international information into potentially actionable strategies thanks to smart pattern analysis. It incorporates salient changes in the economy to probable impacts on the cryptocurrencies and provides users with the means to plan in advance whether for immediate response or for longer-term strategies.

Sermazade identifies optimal entry and exit points in the market by analyzing short-term price shifts, breakouts, and resistance zones. Its advanced algorithms transform complex price action patterns into clear, actionable signals.

Real-time evaluation of support levels and momentum trends provides traders with precise, up-to-date market insights. This timely data empowers Sermazade to streamline trading practices and improve decision-making quality effectively.

Sudden losses can be tough, especially when overly focused on one crypto sector. Sermazade highlights pros and cons across asset categories, helping traders assess group dynamics and maintain a more balanced, responsive portfolio.

Trend changes are heralded by early symptoms. To catch up on such tendencies, Sermazade monitors the main metrics as well as barely visible changes in the behaviors of the trends. These warnings draw attention to prior opportunities, which means that traders can project responsive measures before the entire market re-aligns.

Sermazade senses any major shifts in direction, which are often precursors of momentum breakouts. In supporting these volume fluctuations, the feature consistently enables the user to spot heightening trends. The transition of the market allows the change to occur within a reasonable timeframe.

As disturbing oscillations begin, the formation of good sense in the chaos is conducted by Sermazade. It explains away the surges and pinpoints what instigates that particular disturbance. This specific analysis helps practitioners recollect the basics, rationaliz,e and maintain composure even in challenging situations.

The management must understand that, for instance, if the market continues to fall after buying long futures, concerns about fund withdrawal are often misplaced. The aim is fair market efficiency, not perfection. The EMH holds that investors behave as if in frictionless markets.

Its automated system processes promptly, aiding consistent execution in volatile periods. Freemake fosters imagination-based learning, while Sermazade enhances strategic insight even beyond crypto-focused contexts.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |